Why can’t land be valued online?

All online real estate calculators available on the internet are based on hedonic pricing models, which in turn rely on a multitude of actual transactions. And here lies the problem: In Switzerland, there are far too few land transactions to statistically determine a reliable value.

Why are those obscure lists with square meter prices for building land not useful?

The lack of ongoing building land transactions and the absence of price transparency are also why lists or tables with square meter prices of building land are of little value. Here too, there is no shortcut to determining reliable land values.

How is the market value of land defined?

When it comes to defining market value, opinions differ, and there are various more or less suitable approaches. The appraisal experts of the Swiss Property Owners Association adhere exclusively to the following definition of market value:

The market value of a plot of land is the highest price without limitation that a potential buyer would be willing to pay on the valuation date in a normal business transaction, taking into account all value influences for the said plot of land.

What Are Suitable Methods for Land Valuation?

The Comparative Value Method in Land Valuation relies on current sale prices of similar plots but can vary due to different features and location factors.

1st Choice: Comparative Value Method The preferred method for valuing land is the comparative value method. This approach involves comparing the plot to be valued with the recently traded prices of other, similar plots, adjusting with premiums or discounts. And this is exactly where the problem starts: In Switzerland—unlike in the USA—there are far too few transactions to reliably derive a price. Additionally, these transaction prices are not publicly accessible.

Conclusion: The comparative value method can only be applied in very few cases in practice.

2nd Choice: Residual Value Calculation When comparative prices are unavailable, valuation experts often turn to the residual value method. This method subtracts the theoretical construction costs from the expected value of a new building with maximum utilization to determine the land price.

Example: New Multi-Family House Expected sale price or revenue value: CHF 5,000,000 Expected construction costs (including profit): CHF 3,200,000 Theoretical land value: CHF 1,800,000

Conclusion: The residual value method places high technical demands on the valuation expert, as complex assumptions must be made regarding a possible new construction, its construction costs, and a future sale price. Usually, the valuation expert also consults an architect familiar with local building laws.

What qualifications are needed for land valuation? Valuing land is one of the most advanced aspects of real estate appraisal. Therefore, the valuation of land should be handled by experienced, local, and federally certified real estate experts (e.g., real estate appraisers with a CAS FH, federally certified real estate appraisers, federally certified real estate trustees, real estate economists).

Can laypeople evaluate the value of land themselves? Short answer: No. For both the comparative value method and the residual value calculation, laypeople lack the comparative data and methodological knowledge. Land valuation should only be carried out by experienced, local, and federally certified real estate appraisers.

How much does a professional land valuation cost? A land valuation (usually using the residual value method) costs several thousand francs. Members of the Swiss Property Owners Association can access the expertise of certified real estate appraisers for free.

Free Land Valuation by the Swiss Property Owners Association

All members of the Swiss Property Owners Association can have their land, investment properties, single-family homes, and condominiums valued for free by the association’s certified valuation experts.

Not enough information? Here are more details on land valuation.

What Types of Land Are There in Switzerland? According to Article 655 of the Swiss Civil Code (ZGB), the following are considered land within the meaning of the law: properties, independent and permanent rights recorded in the land register, mines, and co-ownership shares in properties.

For valuation purposes, this categorization is not very helpful in the present context, so we define the following for our valuation purposes:

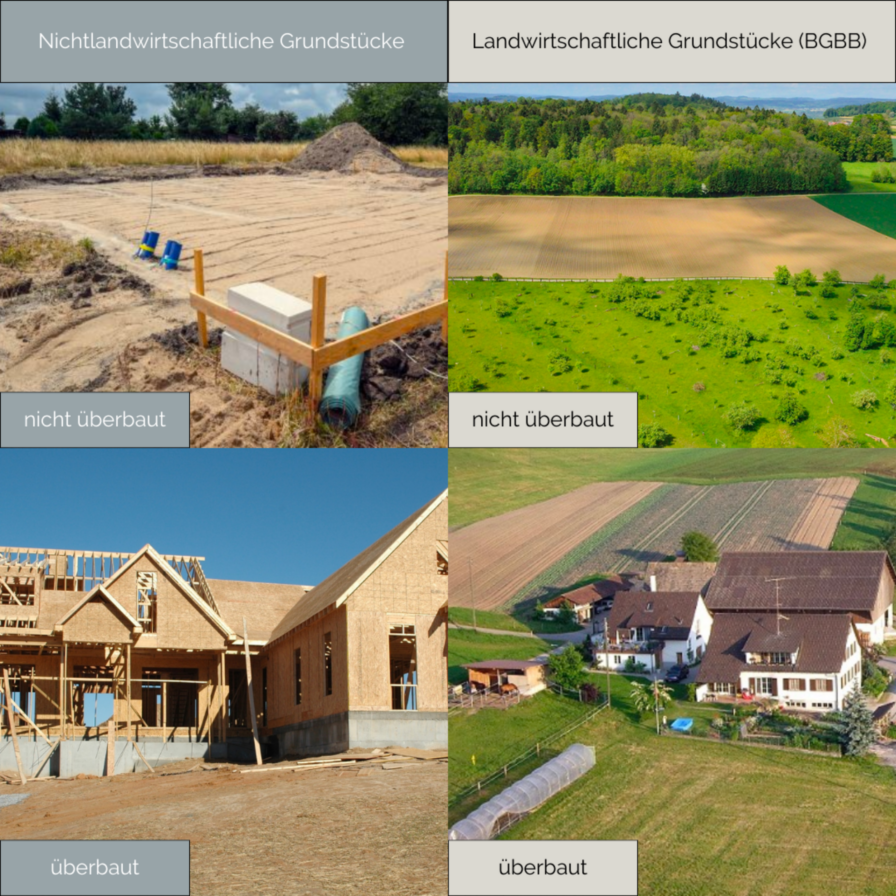

Non-Agricultural Land:

- Developed

- Undeveloped

Agricultural Land (BGBB):

- Developed

- Undeveloped

An undeveloped plot is either a plot without buildings or a developed plot where the market value of the undeveloped land is higher than the market value of the developed land.

Building Land Categories:

- Land Designated for Future Development: Land located outside the construction zone, which could potentially be zoned as building land in the future.

- Building Land: Land located within the construction zone that does not yet have connections for electricity, water, and sewage.

- Building Plot: Developed building land that can be built upon once a building permit is obtained.

Factors Influencing the Value of Building Land:

- Macro Location: In which municipality is the land located?

- Micro Location: Location within a municipality (e.g., view, orientation, distance to public transport and infrastructure, noise pollution).

- Plot Size: The larger, the better.

- Plot Shape: Is it easy or difficult to build on?

- Building Zone: Defines permissible development with regulations on building height, building length, boundary distance, floor area ratio, building mass index, etc.

- Building Regulations: Such as building lines, waterbody distances, protected trees.

- Infrastructure: Are there connections for electricity, water, and sewage?

- Value-Influencing Easements: Such as right of way, right to build close to the boundary, etc.

- Topography: Are there restrictions due to topography?

- Soil Condition: Are there any contaminants?

- Radon: What is the radon exposure level?

- Hazard Zone: Is the land in a hazard zone (e.g., landslide, rockfall, flood)?

- Taxes: What is the tax burden in the municipality?