Personal Stories: Why We Chose to Rent or Buy?

To gain a better understanding of individual decisions, we interviewed some of our association members. These personal stories offer valuable insights into the various considerations and experiences with renting and buying a property.

Renting: The Flexible Option for the Professionally Unbound

Anna, 28, works in the IT industry and loves being flexible in her career and geographically. “I chose to rent because I want to advance my career, which may require me to change my place of residence or even move abroad. The flexibility that renting offers is invaluable to me,” she explains. Anna also appreciates the lower financial commitments and the freedom of not having to worry about maintenance.

Buying: An Investment in the Future

Peter and Julia, both in their mid-30s, bought a single-family home near Bern three years ago. “For us, it was important to have a home for our growing family and at the same time invest in our future,” says Peter. They value the stability and security that owning a home brings. “We can design our home to our liking and know that we are building wealth in the long term,” adds Julia.

These personal anecdotes demonstrate how motives for renting or buying can vary greatly. While flexibility and lower responsibility are attractive to renters, buying property offers long-term stability and the opportunity for asset accumulation

Renting: A Flexible Option

Renting a property offers numerous benefits, especially for those who value flexibility and prefer lower financial commitments. Renters can more easily and usually more quickly change their place of residence, which is particularly advantageous in professional uncertainty or early life stages. “For me, it was important to stay flexible to seize career opportunities, and I also love getting to know new cities – usually, I get bored after a few years,” explains Rolf, a 35-year-old marketing expert.

Rental payments are often more stable and lower than mortgage payments, especially with rising interest rates. This allows renters to better plan their monthly expenses and avoid financial overreach. “The monthly rent gives me the security of having my expenses and budget under control without unexpected additional costs,” says Rolf, for whom owning a property is not among his life goals.

Another advantage is that renters do not have to worry about maintenance and repairs. These tasks are the landlord’s responsibility, saving time and money. “As a renter, I don’t have to worry about repairing the roof or replacing the heating system. This removes a lot of stress and financial burden from my shoulders,” explains Markus from Baden.

The Hidden Costs of Renting

Although renting offers many advantages, there are also some hidden costs and disadvantages that must be considered.

Renting does not lead to asset accumulation since rental payments do not contribute to building equity. “I am aware that I am not building wealth in the long term by renting, and my money is essentially going into ‘someone else’s pocket’ – that does hurt a bit,” says Melanie, a 32-year-old PR consultant.

Rental prices can increase over time, which can become expensive in the long term. In some urban areas, rental prices have risen sharply due to housing shortages and continued high demand, leading to significant financial strain. “When my landlord suddenly raised the rent last year, it became difficult for me to cover my monthly expenses, especially as everything else becomes more expensive,” reports Jonas, a 45-year-old sales manager from Zurich.

Renters often have less freedom to design their living space. Major renovations or modifications are usually not allowed or must be approved by the landlord. “I would like to modernize my kitchen, but as a renter, I am greatly restricted in making major changes,” explains Jonas with a hint of frustration in his voice.

Excursus: Mortgage Reference Interest Rate and Its Impact on Rents in Switzerland

The mortgage reference interest rate is determined by the Federal Office for Housing (BWO) in collaboration with the Swiss National Bank (SNB). This interest rate serves as a basis for calculating rents in Switzerland. It is published quarterly and is based on the average interest rate of outstanding mortgages.

If the reference interest rate rises, landlords are allowed to increase rents to offset the increased financing costs. If the interest rate falls, landlords are required to lower the rents if tenants demand it. These adjustments mean that rental costs in Switzerland are closely linked to interest rate developments.

Buying: Investing in the Future

Buying a property offers numerous advantages, particularly in terms of asset accumulation and long-term stability. Ownership is a long-term investment that contributes to wealth building. “For us, it was important to create a home for our family while simultaneously investing in our future,” explains Thomas, a 38-year-old engineer.

Owners have more control over their living situation and are not threatened by evictions by the landlord, such as when they register a need for personal use. This offers increased stability and security. “We feel safer because we are not affected by sudden evictions,” adds Thomas.

Another advantage of buying is the freedom to design. Owners can customize their property to suit their individual needs. “It’s great that we can renovate our home as we wish without having to ask anyone for permission. I want to be able to express myself a bit in my home,” explains Andreas, a 45-year-old doctor with a strong interest in architecture.

Additionally, mortgage interest and maintenance costs offer tax advantages that can reduce the financial burden. “The ability to deduct mortgage interest and other tax benefits has helped me and my wife financially a lot – it was one of the decisive points why we wanted to buy something ourselves,” says Andreas.

Looking for a New Home?

Explore our latest listings of houses, apartments, and land in Switzerland.

The Challenges of Ownership

Buying a property not only offers advantages but also brings challenges and obligations.

A major disadvantage is the high costs; in recent years, real estate prices, driven by low interest rates, have risen sharply. Buying requires a significant initial investment; in addition to the equity that must be raised, there are also purchase-related costs (land registry, notary fees, real estate agent commissions, etc.). “The initial investment was a big financial challenge for us, but fortunately, we were able to count on the support of our parents,” recounts Fabian, who, with his wife Monika, fulfilled their dream of owning a house with a view of Lake Thun.

Another disadvantage is the reduced flexibility. Buying a property financially binds and makes it more difficult to change residence quickly. “We found that it’s not so easy to sell our house quickly and move when professional changes are imminent,” reports Claudia, a 39-year-old lawyer.

Owners must also take care of maintenance and repairs, which means additional costs and effort. “The responsibility for maintenance lies entirely with us, which can be both time-consuming and expensive. I honestly underestimated this a bit,” adds Claudia.

Financial Considerations and Planning

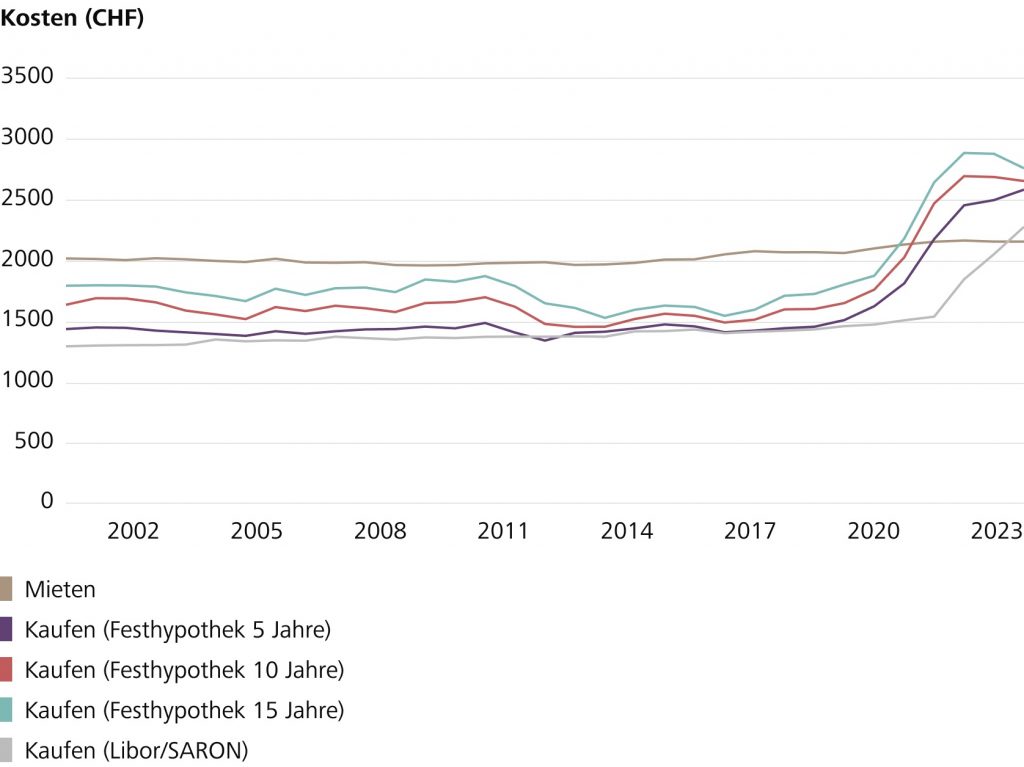

- Long-term Cost Comparison: The decision between renting and buying requires a thorough financial analysis. In the long run, the total costs of renting and buying can vary greatly. While rental expenses often remain constant, the initial costs of buying are high, and the monthly costs can vary depending on the chosen mortgage model and interest rate level. “It was important for us to compare the long-term costs and see that the monthly burden through the mortgage was significantly lower than our previous rent,” says Stefan.

- Equity Requirements and Financing Options: Buying a property typically requires at least 20% of the purchase price as equity. Additional costs such as notary fees and real estate agent commissions also apply. There are various mortgage models that offer different advantages and disadvantages. “We reviewed various financing options and ultimately chose a fixed-rate mortgage to benefit from the low interest rates,” Stefan further reports.

- Tax Considerations: Owners can deduct mortgage interest and value-preserving investments from their taxes. This can be particularly advantageous with high mortgage amounts and regular maintenance costs. “The ability to deduct mortgage interest for tax purposes strongly influenced our decision to buy a house,” explains Andreas.

Excursus: Imputed Rental

Value The imputed rental value is a tax term in Switzerland that refers to the theoretical rental value of a property used by its owner. This amount is added to the owner’s income and taxed. The underlying idea is that owner-occupied housing provides an economic benefit that the state wants to tax. The imputed rental value is determined by tax authorities and can vary depending on the canton and location of the property. There are discussions about abolishing the imputed rental value, but it currently remains a component of the Swiss tax system.

Lifestyle and Personal Considerations

- Life Planning: The decision whether to rent or buy heavily depends on individual life plans. Starting a family, career changes, or the desire for long-term stability can influence this decision. Owning a home provides a stable base for families, while renting offers more flexibility.

- Professional Flexibility: Those who want to remain professionally flexible might find renting a better option. A rented space allows for quicker responses to career changes and the ability to change residence as needed.

- Personal Preferences: Your personal preferences also play a role. Do you enjoy living in an urban environment with many amenities, or do you prefer the tranquility of rural life? These preferences influence both the choice of living location and the decision between renting and buying.

Conclusion

In summary, both renting and buying a property have their own advantages and disadvantages. The decision strongly depends on individual life circumstances, financial capabilities, and personal preferences. A thorough analysis of the long-term costs and careful planning are crucial to making the best choice.

Advice and Support

If you need professional assistance to make an informed decision, our advisors from the Swiss Property Owners Association are at your service:

- Sales: Professional evaluation and marketing

- Support in finding the right property

- Assistance with financial planning and selecting the appropriate mortgage model

- Advice on legal aspects of rental or purchase agreements

These services aim to guide you through the complexities of the real estate market, ensuring you have the information and support needed to make decisions that align with your personal and financial goals. Whether you’re considering renting or buying, understanding the financial implications, legal obligations, and market conditions can be crucial for a successful outcome.